Bank Of Canada Inflation Forecast 2025

Bank Of Canada Inflation Forecast 2025. If inflation cools enough, the bank of canada may begin easing interest rates towards. The bank projects that inflation will reach the 2% target by.

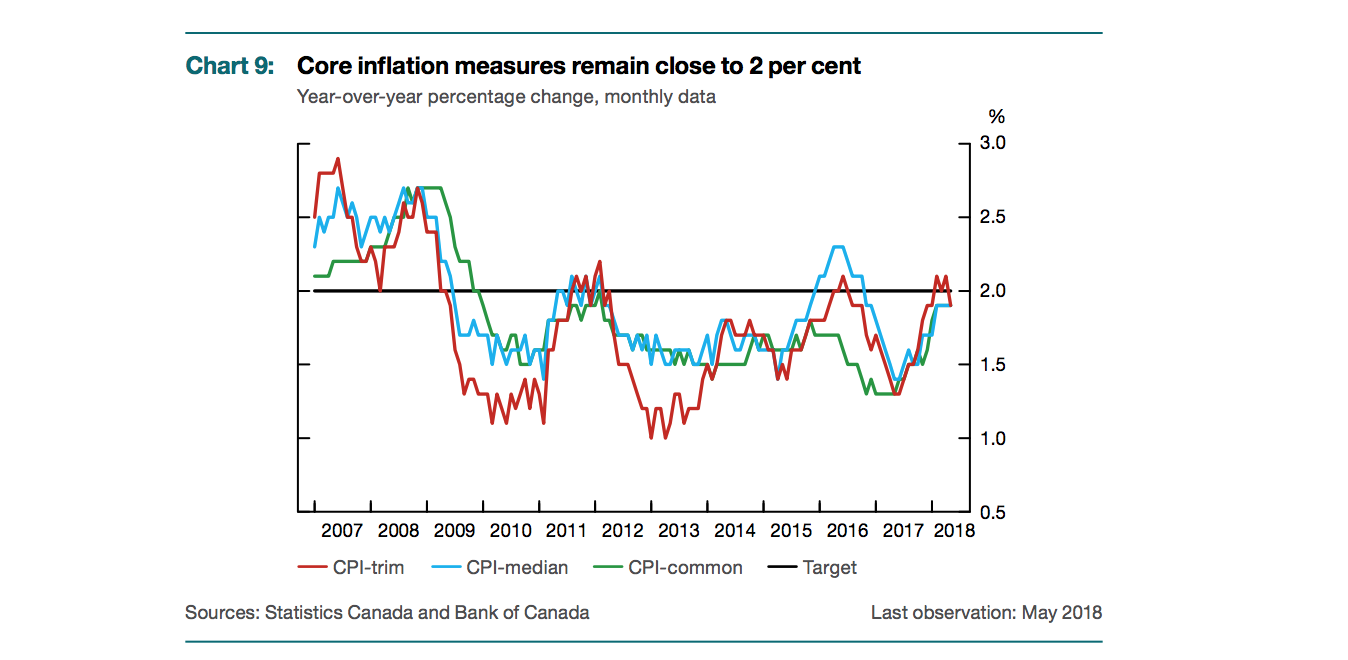

In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where. Monetary policy is working to reduce inflationary pressures and inflation is coming down, although it will take more time to see if this progress proves durable.

The impact of high inflation on benefit claimants, Monetary policy is working to reduce inflationary pressures and inflation is coming down, although it will take more time to see if this progress proves durable. The bank of canada now projects the canadian consumer price index (cpi) to come to an average of 4.1 per cent in 2025, down from a prior forecast of 4.6 per.

IMF Pertumbuhan Ekonomi Global 2025 Alami Penurunan Stabilitas, In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where. The bank projects that inflation will reach the 2% target by.

In Canada, hot inflation opens rare attack on central bank Flipboard, We do not believe stable 2% inflation will be achieved until the end of 2025. While we expect inflation to be lower than we've experienced over the past two years, price.

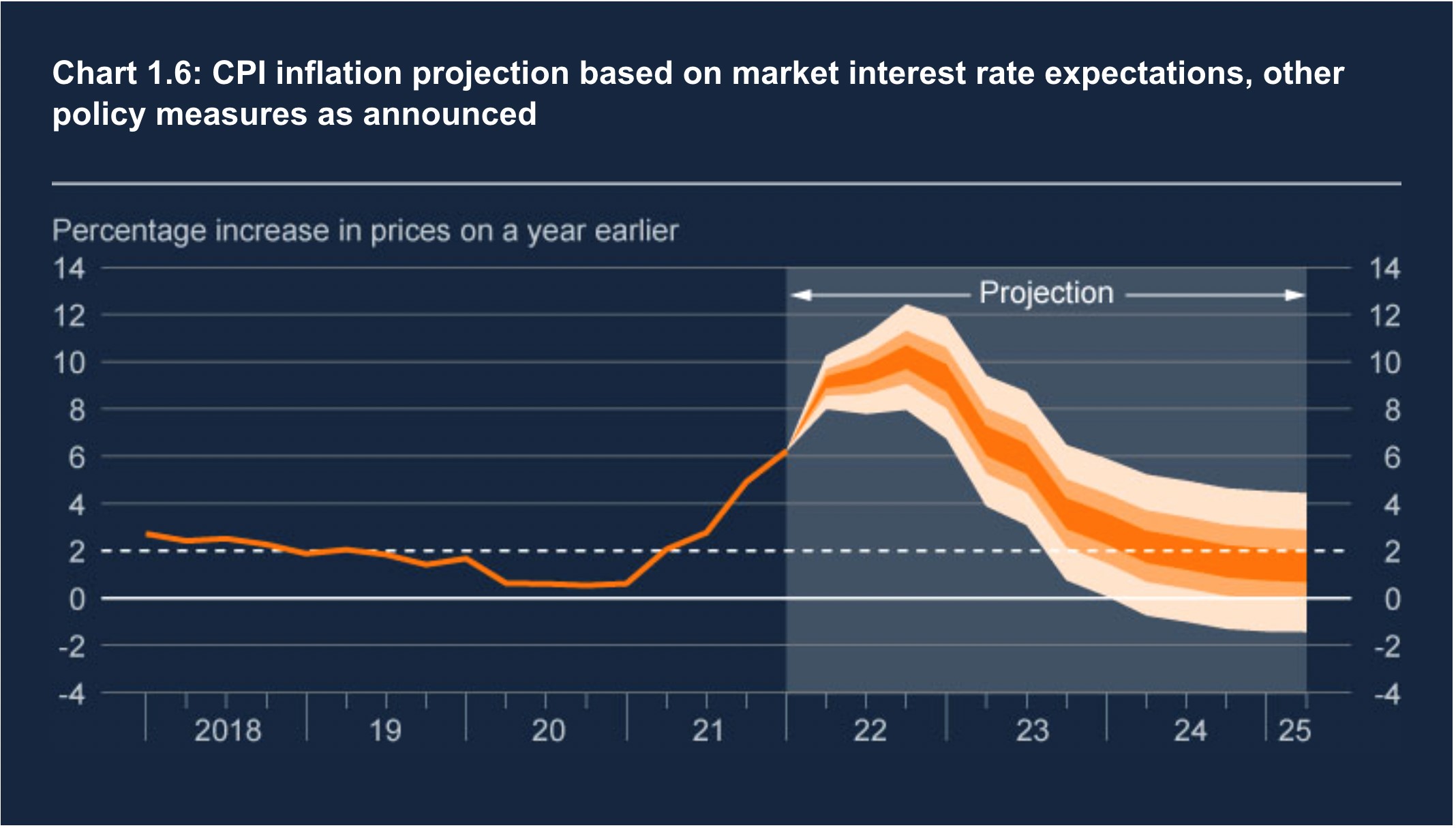

Has the Bank of England overdone the gloom?, While we expect inflation to be lower than we've experienced over the past two years, price. Bloomberg, bank of canada, federal reserve, td economics.

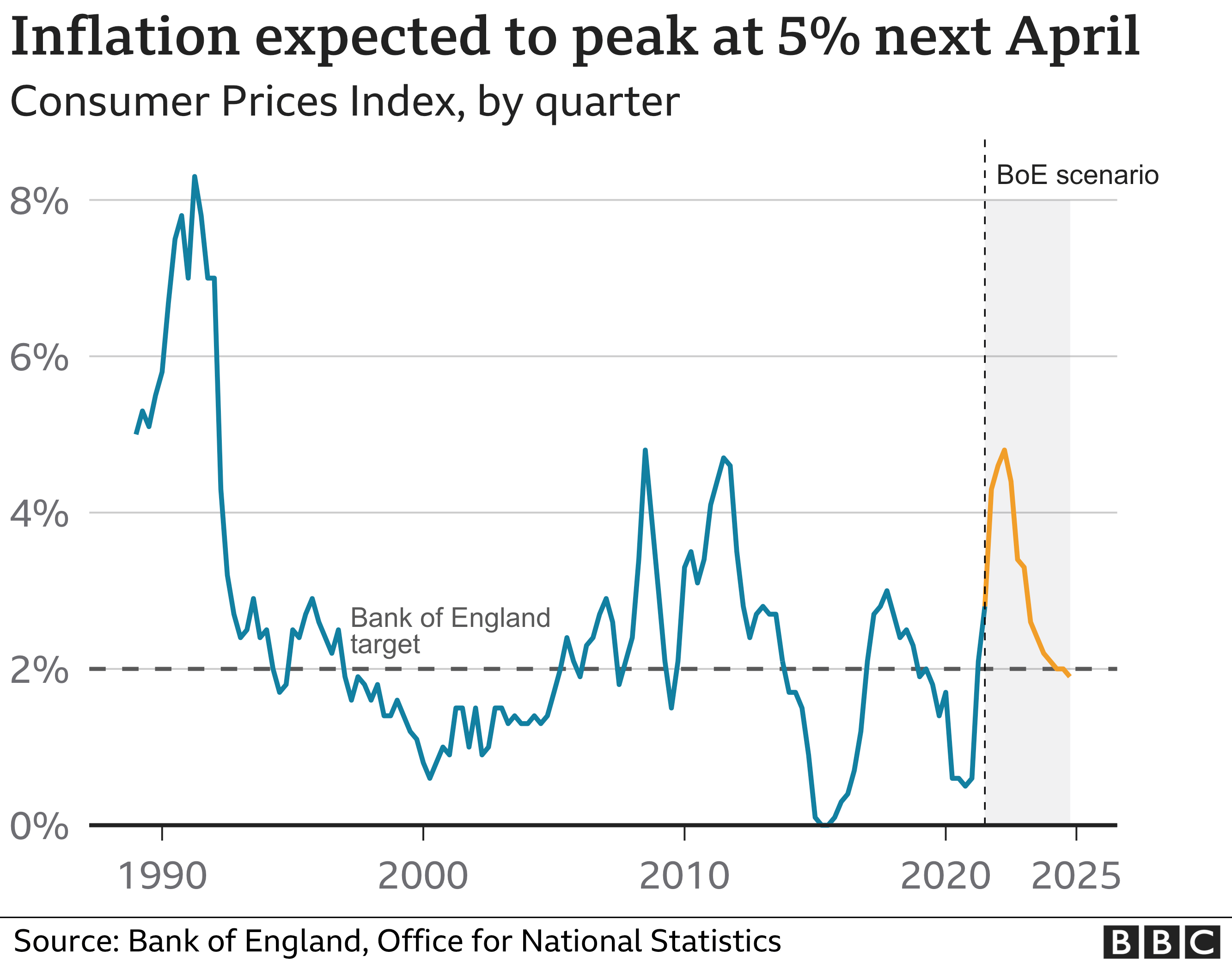

Bank of England hints at future interest rate rise BBC News, In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where. Traders boost odds of june rate cut as canada inflation cools cpi rose 2.8% in february, below expectations of 3.1% bank of canada’s preferred core.

Inflation Forces the Bank of Canada’s Hand Ahead of Fed and ECB Bloomberg, In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where. The bank of canada's first interest rate decision of the year is due wednesday.

Understanding inflation and its impact on your money Posts, In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where. Traders boost odds of june rate cut as canada inflation cools cpi rose 2.8% in february, below expectations of 3.1% bank of canada’s preferred core.

This is Why the Bank of Canada Raised Interest Rates Kingmount Capital, While that forecast still sees inflation returning to the bank’s two per cent target in 2025, it now calls for inflation to cool to 2.2 per cent by the end of 2025, down. The boc will hold rates on wednesday and at its next meeting in march, according to a reuters poll of 34 economists.

UK Unemployment to Rise and Inflation to Plunge in 2025, Triggering a, Monetary policy is working to reduce inflationary pressures and inflation is coming down, although it will take more time to see if this progress proves durable. Inflation in canada remains high but should come down quickly to around 3% in the middle of this year because of lower energy prices, improved supply chains and restrictive monetary policy.

DLC Parato Mortgage Group Posts tagged as "TOP BANKS", After a period of high inflation, we expect headline and core consumer price inflation to decelerate back to the 2% target over the medium term. In response to rising inflation, the bank of canada rapidly raised its benchmark interest rate by 4.75 percentage points to 5 per cent, as of july 2025—where.

The central bank now expects inflation to average 7.2% in 2025, up from 5.3% forecast in april, easing to about 3% by the end of 2025, and then back to the 2%.

After a period of high inflation, we expect headline and core consumer price inflation to decelerate back to the 2% target over the medium term.